DeFi Lend Borrow : Solidity Contracts

DeFi Lend Borrow is a decentralized finance (DeFi) application that enables users to lend and borrow assets on the Shimmer EVM testnet. The project is built using Solidity and Hardhat, with the core functionality provided by smart contracts.

Prerequisites

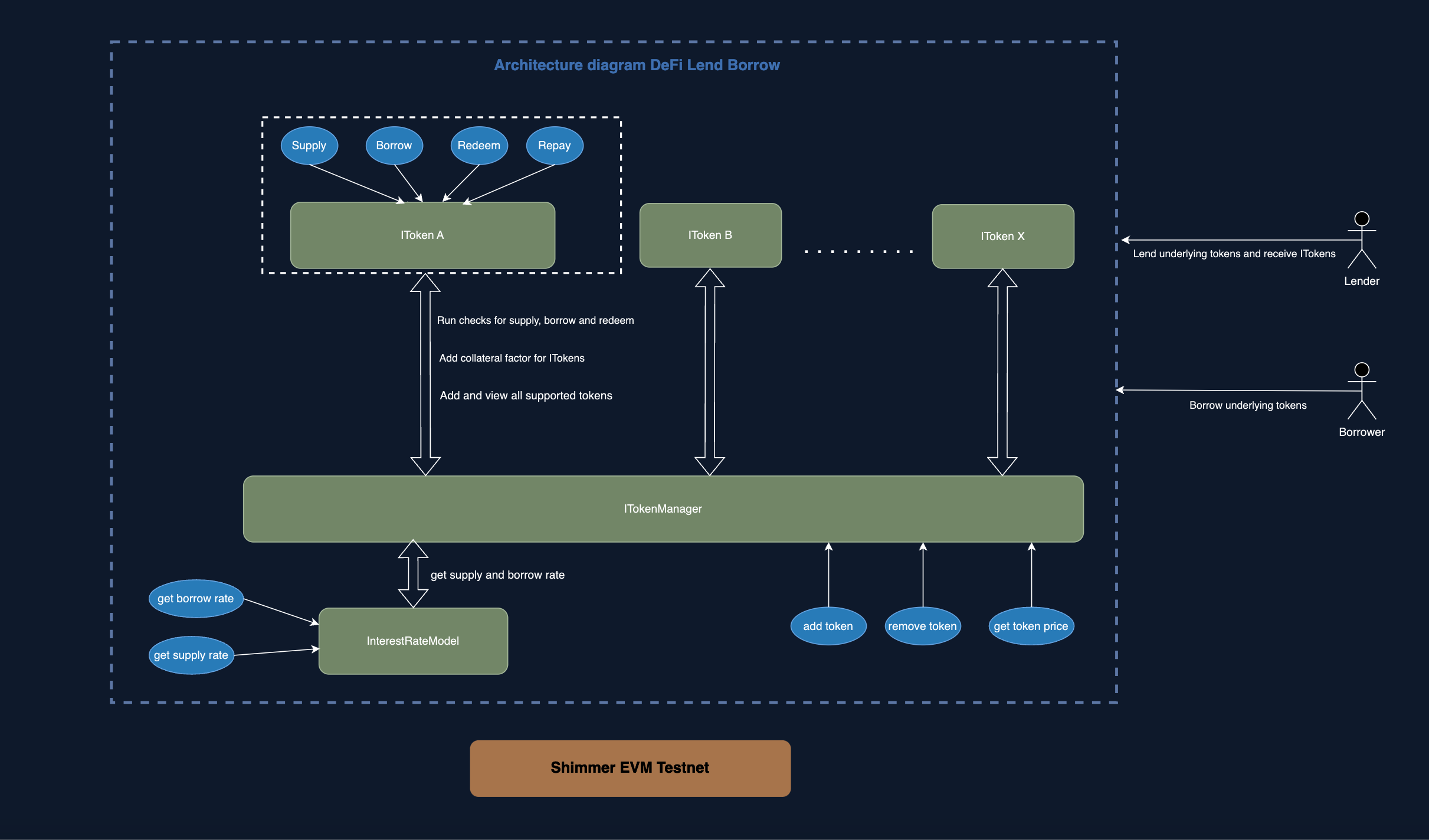

DeFi Lend Borrow Contracts Architecture Overview

Set Up

First, create a new directory for the project and navigate into it:

mkdir defi-lend-borrow

cd defi-lend-borrow

Then bootsrap a new Hardhat project, by running:

npx hardhat init

Configuration

In the hardhat.config.js file, update the networks object to include the ShimmerEVM Testnet network configuration, as well as the BNB Testnet network configuration.

loading...

Contracts Overview

IToken

The IToken contract is an ERC20 token that represents an interest-bearing asset with lending and borrowing functionalities.

- Underlying Asset: The ERC20 token that this contract wraps.

- Interest Rate Model: Determines the interest rates for borrowing and supplying assets.

- ITokenManager: Manages supported tokens and collateralization.

Key Functions

- Mint: This method allows users to mint

ITokenby depositing a specified amount of the underlying token.- Transfers the specified amount of the underlying token from the user to the contract.

- Mints an equivalent amount of IToken to the user's balance.

- Updates the user's collateral in the

ITokenManager. - Returns a boolean indicating whether the minting process was successful.

loading...

- Redeem: This method enables users to redeem

ITokenin exchange for the underlying token.- Ensures the user has enough IToken to redeem.

- Burns the specified amount of IToken from the user's balance.

- Transfers the equivalent amount of the underlying token from the contract to the user.

- Updates the user's collateral in the

ITokenManager. - Returns a boolean indicating whether the redemption process was successful.

loading...

- Borrow: Borrows the underlying token from the contract. This method allows users to borrow the underlying token from the contract.

- Calculates the borrow rate and the interest for the specified amount.

- Ensures the contract has enough liquidity and the user has sufficient collateral.

- Increases the user's borrow balance by the borrowed amount plus interest.

- Updates the total amount borrowed in the contract.

- Transfers the borrowed amount of the underlying token to the user.

- Returns a boolean indicating whether the borrowing process was successful.

loading...

- Repay: This method allows users to repay the borrowed underlying token.

- Ensures the repayment amount does not exceed the user's borrow balance.

- Transfers the repayment amount from the user to the contract.

- Calculates the interest on the repayment amount and adjusts the user's borrow balance accordingly.

- Updates the total amount borrowed and the contract's reserves.

- Updates the user's collateral in the

ITokenManager. - Returns a boolean indicating whether the repayment process was successful.

loading...

getBorrowRate(): Returns the current borrow rate per block.

loading...

getSupplyRate(): Returns the current supply rate per block.

loading...

You can review the full code for the IToken contract in the tutorial's Repository.

InterestRateModel

The InterestRateModel contract calculates the interest rates for borrowing and supplying assets based on the utilization of the underlying assets.

Key Functions

utilizationRate(uint cash, uint borrows, uint reserves): Calculates the utilization rate of the market.

loading...

getBorrowRate(uint cash, uint borrows, uint reserves): Calculates the current borrow rate per block.

loading...

getSupplyRate(uint cash, uint borrows, uint reserves, uint reserveFactorMantissa): Calculates the current supply rate per block.

loading...

We have now covered all relevant parts and working of the InterestRateModal contract, here is the link for the full contract code for your reference.

ITokenManager Contract

The ITokenManager contract is designed to manage supported tokens and collateral balances for a decentralized finance (DeFi) platform. It allows for adding, removing, and updating supported tokens, tracking their USD prices, and performing pre-mint, pre-redeem, and pre-borrow checks for liquidity.

Key Features

- Manage supported tokens: Add, remove, and view the supported

ITokencontracts. - Collateral management: Track and update collateral balances for each account and token.

- USD price tracking: Maintain USD prices for each supported token.

- Pre-mint/redeem/borrow checks: Ensure that accounts meet collateral requirements before minting, redeeming, or borrowing tokens.

- Collateral factor: Set and use collateral factors for different tokens to adjust borrowing limits.

Key Functions

addToken(address token, uint256 tokenUSDPrice, uint256 tokenCollateralFactor): Adds a newITokento the manager.- Parameters:

token: The address of theITokento be added.tokenUSDPrice: The USD price of the token.tokenCollateralFactor: The collateral factor for the token.

- Modifiers:

onlyOwner - Events: Emits

TokenAddedupon successful addition of the token.

- Parameters:

loading...

removeToken(address token): Removes anITokenfrom the manager.- Parameters:

token: The address of theITokento be removed.

- Modifiers:

onlyOwner - Events: Emits

TokenRemovedupon successful removal of the token.

- Parameters:

- `preMintChecks(address ITokenAddress)` : Ensures that the token is supported before minting.

- **Parameters:**

- `ITokenAddress`: The address of the `IToken` to be minted.

- **Reverts:** `TokenNotListed` if the token is not supported.

```solidity reference

https://github.com/iota-community/Defi-lend-borrow/blob/3a368391f4767d1decb209ad6bfdd20a2b08fa03/contracts/ITokenManager.sol#L113-L122

preRedeemChecks(address iTokenAddress, address redeemer, uint256 amount): Ensures that the redeemer has sufficient collateral to redeem tokens.Parameters:

iTokenAddress: The address of theITokento be redeemed.redeemer: The account attempting to redeem.amount: The amount of tokens to be redeemed.

Reverts:

RedeemAmountTooMuchif the collateral is insufficient.

loading...

preBorrowChecks(address iTokenAddress, address redeemer, uint256 amount): Ensures that the redeemer has sufficient collateral to borrow tokens.Parameters:

iTokenAddress: The address of theITokento be borrowed.redeemer: The account attempting to borrow.amount: The amount of tokens to be borrowed.

Reverts:

BorrowAmountTooMuchif the collateral is insufficient.

loading...

hasLiquidity(address account, address iToken, uint256 redeemTokens, uint256 borrowTokens) → (uint256 totalAccountCollaterals, uint256 totalAccountBorrows): Calculates the total collateral and borrow balances for an account, accounting for tokens to be redeemed or borrowed.- Parameters:

account: The account to check.iToken: The token in question.redeemTokens: The number of tokens to redeem.borrowTokens: The number of tokens to borrow.

- Returns:

totalAccountCollaterals: The total collateral balance.totalAccountBorrows: The total borrow balance.

loading...

updateTokenUSDPrice(address token, uint256 newUSDPrice): Updates the USD price of a supported token.Parameters:

token: The address of the token.newUSDPrice: The new USD price for the token.

Modifiers:

onlyOwner,onlySupportedTokenReverts:

TokenNotListedif the token is not supported.

loading...

getTokenUSDPrice(address token) → uint256: Returns the USD price of a supported token.Parameters:

token: The address of the token.

Returns: The USD price of the token as a

uint256.

loading...

We have now covered all relevant parts and the functionality of the ITokenManager contract. For reference, you can follow the full contract code.

Underlying Token

The MockERC20 contract is a simple ERC20 token used for testing purposes. It allows minting of an initial supply to the deployer. You can add this token to the ITokenManager and mint new ITokens by depositing the MockERC20 tokens as the underlying Token.

Scripts

Compile Your Contracts

We can compile our contracts created above using the below command. This command compiles your Solidity smart contracts, checking for errors and generating necessary artifacts, including the ABI (Application Binary Interface) and bytecode. These artifacts are stored in the artifacts/ directory and are essential for deploying and interacting with the contracts.

npx hardhat compile

First, create a scripts folder in the root of the project and add the following files under it:

Deploy Script

The deploy.js script will deploy the contract to the ShimmerEVM Testnet.

loading...

This will deploy the Defi Lend borrow contract to the ShimmerEVM Testnet. run it by executing:

npx hardhat run scripts/deploy.js --network shimmer_evm_testnet

Verfication

You can verify your contract by visiting the EVM Testnet Explorer,

and searching for the address from the previous step. If you access the Contract tab, you should be able to see your code and interact with your contract or you can use the below command to verify the contracts through hardhat :

npx hardhat verify --network shimmer_evm_testnet CONTRACT_ADDRESS_HERE "CONSTRUCTOR_ARGUMENTS_IF_ANY"

Conclusion

In this first part of the DeFi Lend Borrow tutorial, we have set up the project and deployed the Itoken contract to the ShimmerEVM Testnet. We have also deployed the Underlying Token's contract and the Itoken Manager contract.Now using Itoken contract you can lend and borrow tokens. In the next part, we will create the DeFi Lend Borrow UI using React.js.